Renters Insurance in and around Rogers

Looking for renters insurance in Rogers?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Rogers Renters!

Home is home even if you are leasing it. And whether it's an apartment or a condo, protection for your personal belongings is a wise idea, even if your landlord doesn’t require it.

Looking for renters insurance in Rogers?

Coverage for what's yours, in your rented home

There's No Place Like Home

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented apartment include a wide variety of things like your video game system, exercise equipment, tablet, and more. That's why renters insurance can be such a good move. But don't worry, State Farm agent Chase Foust has the personal attention and efficiency needed to help you choose the right policy and help you keep your belongings protected.

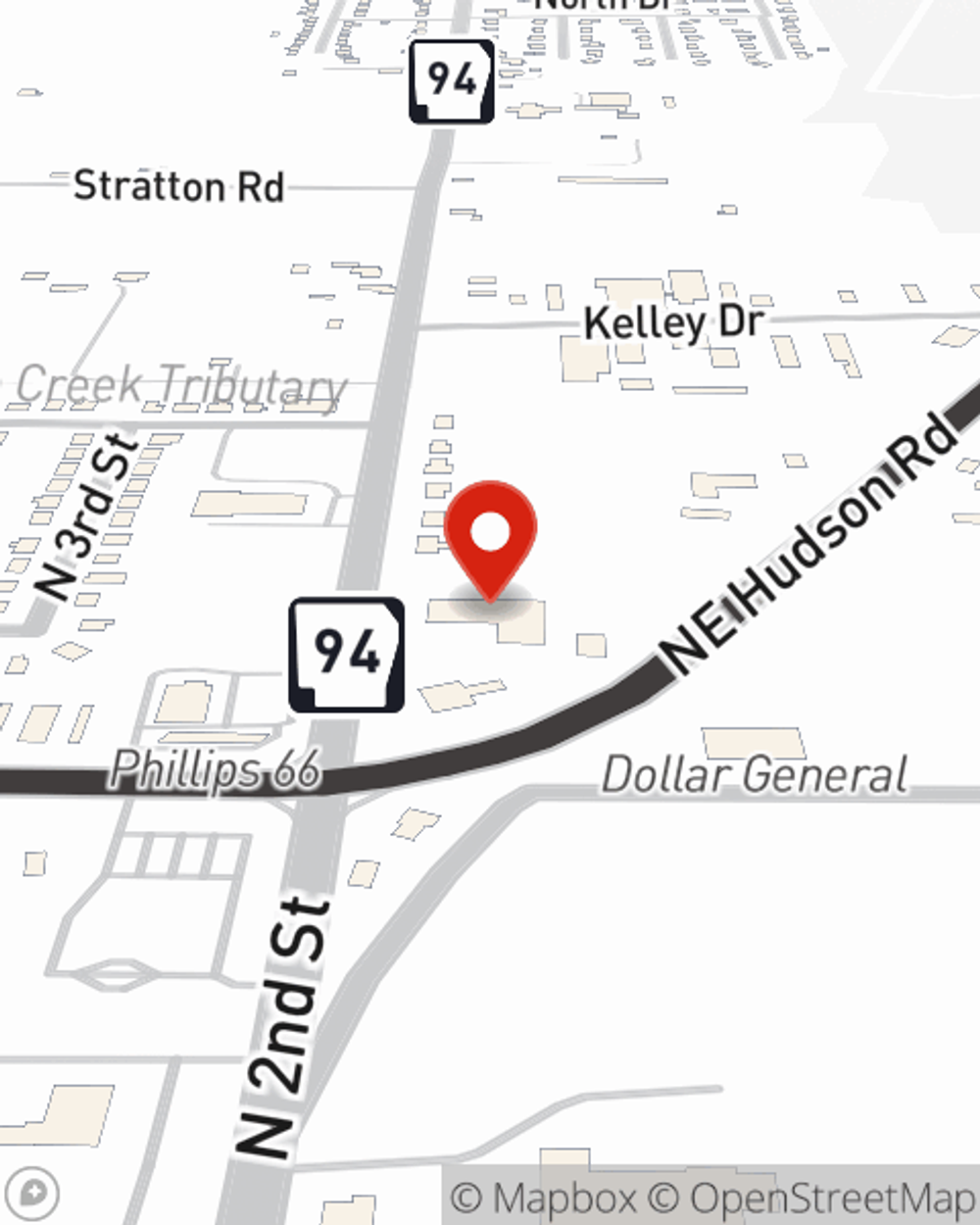

A good next step when renting a home in Rogers, AR is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online today and see how State Farm agent Chase Foust can help you.

Have More Questions About Renters Insurance?

Call Chase at (479) 282-1078 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Chase Foust

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.